Banner yr beckons once more for India after $19 billion IPO file – Instances of India

India has transform probably the most international’s main markets for offers equivalent to preliminary public choices, smashing its file for cash raised this yr as buyers snap up alternatives.

Vishal Mega Mart Ltd.’s buying and selling debut Wednesday underscored this insatiable urge for food for IPOs — stocks of the store surged greater than 40%. The feeding frenzy is about to roll into 2025, in keeping with a number of ladies at the entrance traces.

“We’re gearing up for some other busy yr, each relating to IPOs and M&A,” stated Sonia Dasgupta, a managing director and leader govt officer of funding banking at JM Monetary Ltd.

Dasgupta used to be talking right through a roundtable dialogue with different feminine leaders in Mumbai, speaking about India dealmaking and their position in powering the increase.

“Organizations which can be in a position to draw, retain and nurture ladies have the leverage of a larger and higher pool of ability,” Dasgupta stated. Her corporate’s meritocratic machine “all the time takes priority,” which ends up in important participation through ladies at more than a few ranges, she stated.

“After all, it comes all the way down to anyone’s talent and experience,” added Surbhi Kejriwal, a spouse at legislation company Khaitan & Co.

At the offers entrance, multinational corporations are bearing in mind more than a few choices for making improvements to potency, and that incorporates exiting the marketplace, promoting stocks or increasing, Dasgupta stated.

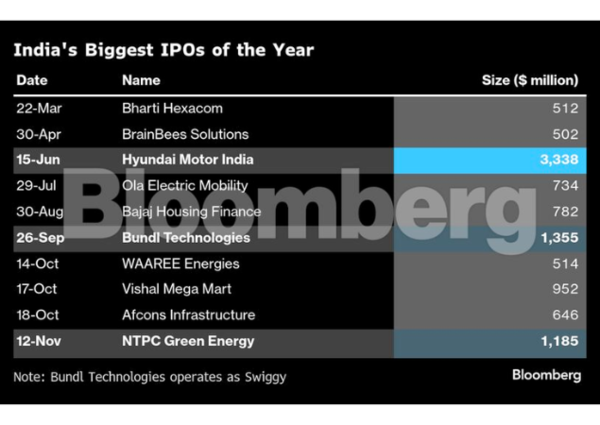

Greater than $19 billion has been raised in IPOs in India since January, beating the former annual file of $17.8 billion in 2021. They come with the rustic’s biggest-ever checklist, which noticed Hyundai Motor Co.’s native unit elevate $3.3 billion. Two others — food-delivery company Swiggy Ltd. and NTPC Inexperienced Power Ltd. — additionally crowned $1 billion, whilst Vishal Mega Mart’s wasn’t a long way off.

Sturdy financial expansion has enticed international buyers, and the billions of greenbacks funneled into home mutual finances each and every month have supported the fairness markets even if some foreigners have been promoting. The benchmark Sensex is up kind of 10% in 2024 and indisputably destined for a ninth-straight yr of features.

“The extent of IPO job in 2024 has been exceptional, thank you partly to a surge in call for from each institutional and retail buyers,” stated Dhruvi Kanabar Shahra, the founding father of circle of relatives workplace DHSK Advisors, who in the meantime famous that generation and faraway paintings have come in useful when forming a circle of relatives, specifically for girls.

“As a mom of very younger children, discovering the fitting work-life steadiness is vital,” she stated.

Extra Offers

Extra IPOs are at the horizon. LG Electronics Inc. is thinking about expanding the valuation of its Indian unit to up to $15 billion in a list in Mumbai subsequent yr, in accordance other folks acquainted with the topic, and Carlyle Crew Inc. is claimed to be weighing an IPO of engineering products and services company Quest World Products and services Pte.

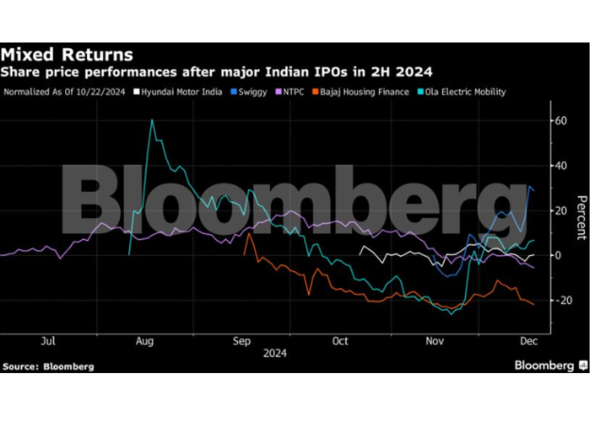

Now not all of the IPOs have resulted in stellar features. After its file effort, Hyundai India is buying and selling under its be offering value of one,960 rupees in step with proportion. However winners simply outnumber losers within the larger IPOs. Bajaj Housing Finance Ltd. is greater than 80% above its be offering value after checklist in September, and each Bharti Hexacom Ltd. and Swiggy have had considerable features.

A rising chew of job might gravitate towards mergers and acquisitions, specifically in spaces such because the infrastructure, health-care and client sectors, Khaitan’s Kejriwal stated.

The amount of M&A offers concentrated on Indian companies has climbed 19% to $42.3 billion this yr, information compiled through Bloomberg display. High quality Care India Ltd., sponsored through Blackstone Inc., agreed in November to mix with Aster DM Healthcare Ltd. in an all-stock deal to create one in all India’s greatest health center chains.

A consortium led through Blackstone additionally emerged as the most well liked bidder for a stake in Haldiram Snacks Pvt., other folks acquainted with the topic have stated, following months of negotiations.

Adani Crew this week introduced plans to consolidate its cement operations through merging two gadgets below Ambuja Cements Ltd. as billionaire Gautam Adani streamlines a industry this is essential for India’s infrastructure push.

“We think much more M&A job in 2025, with monetary sponsors using a large phase,” Kejriwal stated. “We’re seeing expanding hobby from international buyers, which is able to most likely assist India stay a hotspot for dealmaking in Asia.”

1731570357-0/elon-musk-(1)1731570357-0.jpg?w=800&resize=800,450&ssl=1)